How much super do I need for a comfortable retirement?

As hard as it is to believe, just 150 years ago the average lifespan was 40 years. What we’d consider mid-life today was a full innings for our great-great-grandparents.

Today, Australia enjoys one of the highest life expectancies in the world, at 80.7 years in 2018 for males and 84.9 for females at birth — ranked seventh among 37 Organisation for Economic Co-operation and Development (OECD) countries. This means that if you stop working at 65, you’ll need retirement income for 20 years or more.

Have you been contributing enough to super?

In the years leading up to retirement, your focus will probably shift away from the day-to- day financial matters, such as paying off the mortgage, to thinking about your retirement. How much money will you need? Have you been contributing enough to super and how can you increase your superannuation balance to fund a comfortable retirement?

What are the ‘big costs’ that might be part of your plan for a comfortable retirement?

With rising life expectancy and healthcare inflation, you can expect your medical expenses to be some of the biggest in retirement, and they will most likely increase with age. Other expenses might include paying off the mortgage, rent, renovating your home and travel.

What lifestyle do you want for a comfortable retirement?

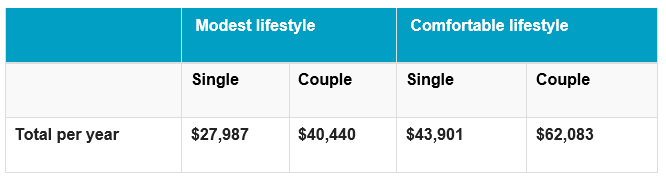

Think about how you plan to spend your money in retirement. If you own your own home, a rule of thumb is that you’ll need two-thirds (67%) of your pre-retirement income to maintain the same standard of living in retirement. The Association of Superannuation Funds of Australia (ASFA) provides an industry retirement standard. This estimates how much money you’ll need, depending on your lifestyle.

Budgets for various households and living standards for those aged around 65 (September quarter 2020, national)

How much super will you need at retirement?

According to ASFA figures,the lump sum needed to support a comfortable retirement is $640,000 for a couple and $545,000 for a single person. This assumes a partial Age Pension. ASFA estimates that a modest lifestyle, which covers the basics, is mostly met by the Age Pension. They estimate the lump sum needed to support a modest lifestyle for a single or couple is $70,000.

Building up your super for a comfortable retirement: what you need to consider

Many factors contribute to your retirement income, including investments outside of super and assets such as your home. If you decide it is important to build your superannuation, there are some actions that can make a big difference.

- Consolidating your super into one account to reduce fees

- Making extra contributions to grow your super

- Changing your super investment options

Careful retirement planning counts

It’s important to consider that your retirement may last a long time. Careful planning before you retire can make a big difference to your superannuation balance, making it last longer and giving you peace of mind that your hard-earned wealth is protected. If you don’t have as much as you’d like, it’s never too late to build up your super to boost your retirement savings. The team of experts here at Smarter Financial & Insurance Solutions in Port Macquarie regularly assist our clients with retirement planning. For all enquiries and to start planning for a comfortable retirement, be sure to get in touch with us today on 02 6584 2166.